tax shield formula uk

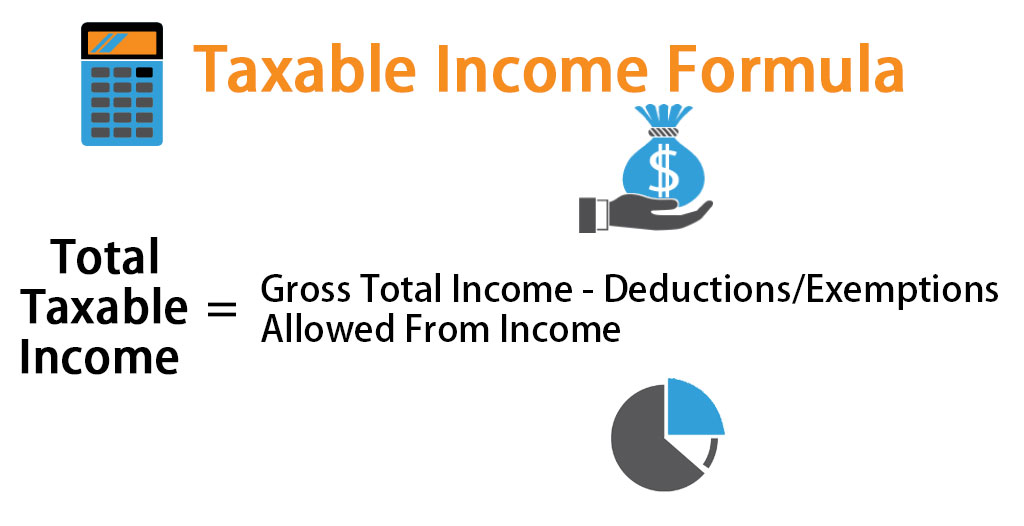

The expression CI CO D in the first equation represents the taxable income which when. This is usually the deduction multiplied by the tax rate.

Discounted Cash Flow Dcf Valuation Investment Guide

Interest bearing debt x tax rate.

. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Tax Shield Deduction x Tax Rate. Value of firm after-tax income return of capital therefore.

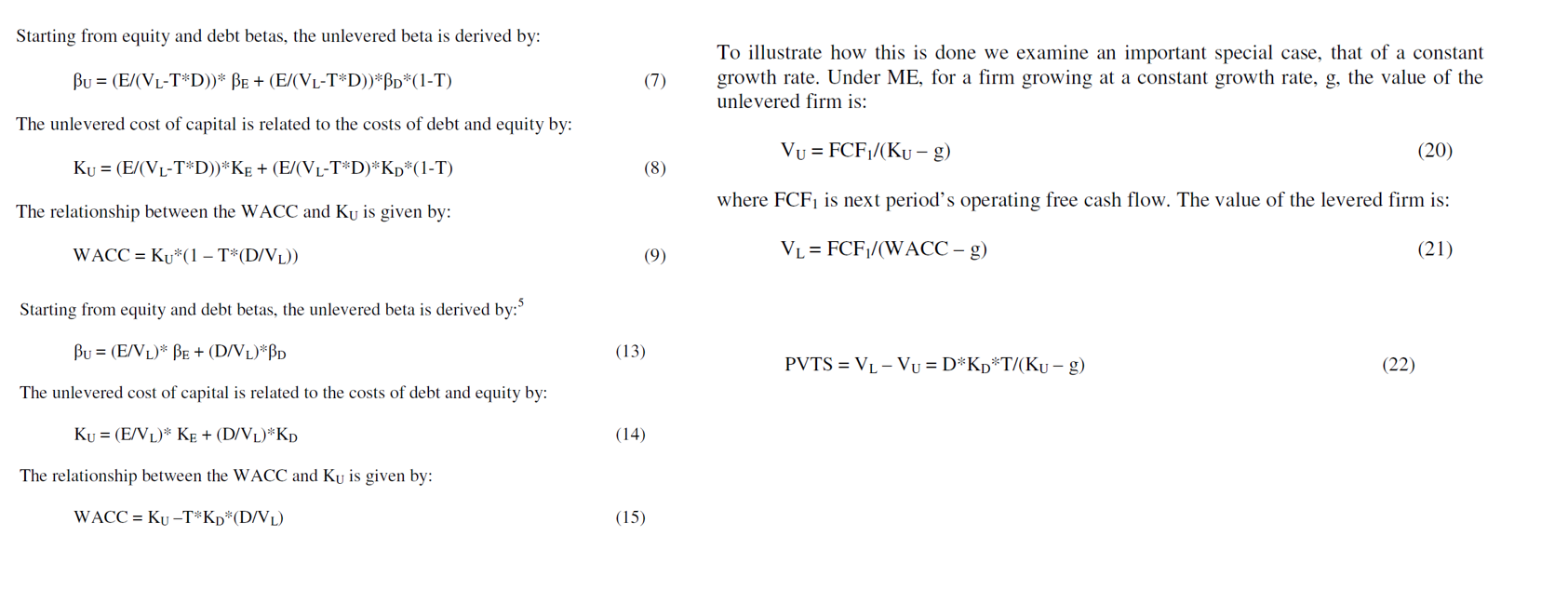

A typical tax shield adjustment is that usually done in WACC calculations where the usual approach is to multiply the interest rate by. Sum of Tax Deductible Expenses 10000. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation expense.

D the value of debt. For example if you expect interest on a mortgage to be 1200 for the year and your tax rate is 20 the amount of the tax shield would be 240. To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate.

The formula looks like this. Taxshield is a trading name of Shield Products Limited. And if the leverage ratio were doubled the debt tax shield could be shown to contribute almost a quarter of the value of the company.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Example of the. Because of tax shields it is necessary to adjust the cost of debt when comparing it to the cost of equity.

Approach to valuing the debt tax shield is simply to multiply the amount of debt by the tax rate in which case the debt tax shield would be seen as contributing 12 of total value. Tax Shield Value of Tax-Deductible Expense x Tax Rate. The effect of a tax shield can be determined using a formula.

In this case straight-line depreciation is used to calculate the amount of allowable depreciation. TAX SHIELD APPROACH 2. A tax shield is the tax saving made by using debt rather than equity.

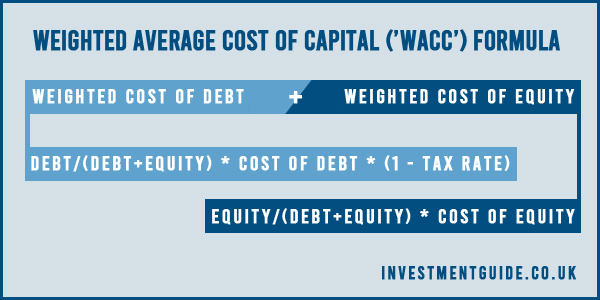

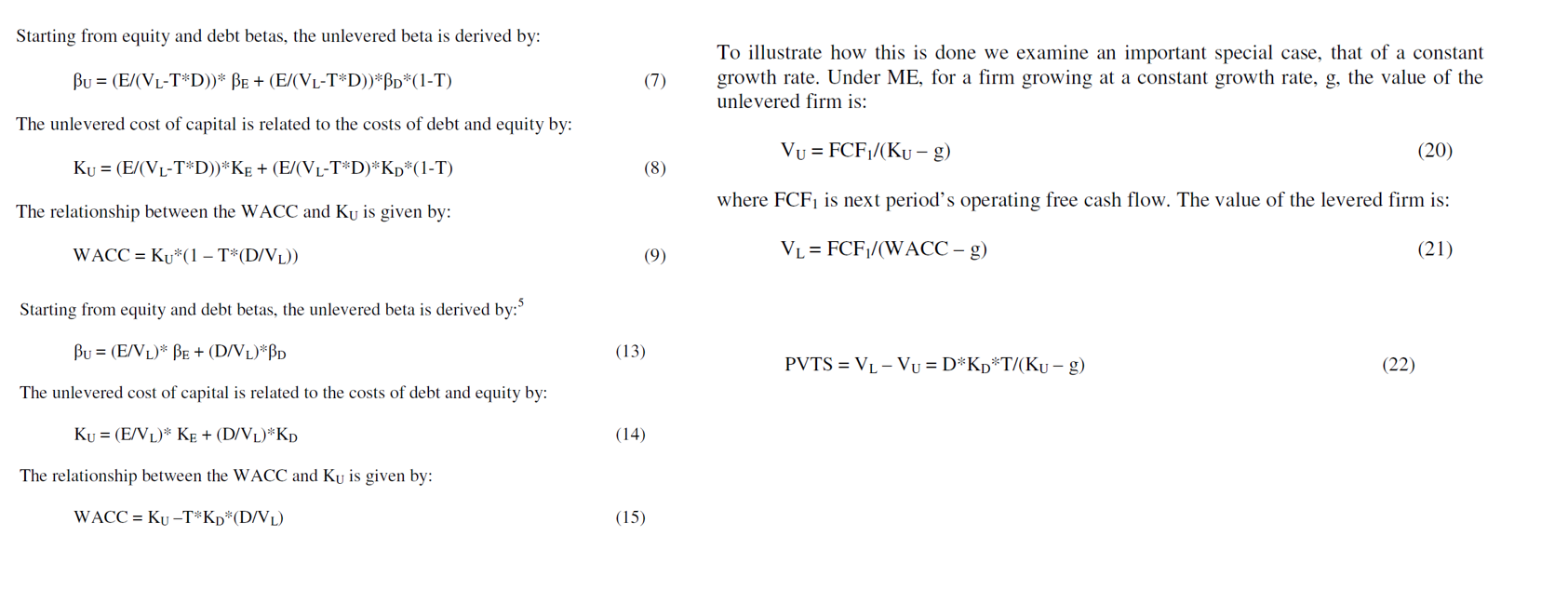

Assume Case B brings after-tax income of 144 per year forever. E V x Ce D V x Cd x 1 - T WACC. To learn more launch our free accounting and finance courses.

Cd the cost of debt. Ce the cost of equity. This approach takes into account the benefits of raising debts like an interest tax shield.

These two equations are essentially the same. Using the above examples. This is usually the deduction multiplied by the tax rate.

V D E. Bottom-Up approach OCF NI depreciation Top-Down approach OCF Sales Costs Taxes Tax Shield Approach sales - costs 1-T Depreciation T. Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375.

If you have 1000 in interest expense for the year with a 35 percent tax rate your tax shield would be 350. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. The second way is by using the Adjusted Present Value formula.

Use these articles to find and calculate the corporate tax rate and individual tax rates for the current year. Tax Shield 10000 40 100 Tax Shield 4000. Interest Tax Shield Formula.

T the tax rate. Calculating the tax shield can be simplified by using this formula. The effect of a tax shield can be determined using a formula.

To increase cash flows and to further increase the value of a business tax shields are used. 1 1 - t Where t is the percentage tax rate. Assume Case A brings after-tax income of 80 per year forever.

Interest Tax Shield Example. Under this assumption the value of the tax shield is. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

44 0870 609 1918. Tax Returns UK Property Foreign and more Partnership Tax Manager takes care of everything you need to submit your Partnership Tax return quickly and easily in time for the filing deadline. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

Although Miles and Ezzell do not mention what the value of tax shields should be their formula relating the required return on equity with the required return for the unleveraged company implies that VTS PVKu. E the value of equity. Finch House 2830 Wolverhampton Street Dudley West Midlands DY1 1DB.

CF CI CO CI CO D t. F O R M U L A S Operating cash flow formulas. The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below.

This gives you a good idea of the tax shield on that item. Tax Shield Deduction x Tax Rate. Calls to this number are charged at local rates however may vary from other landlines and calls from mobiles may cost considerably more.

T D Kd 1Ku1Kd0 4 IESE Business School-University of Navarra - 5. Interest Tax Shield Average debt Cost of debt Tax rate. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed.

Silver Whiskey Barrel Ring 8mm Offset Whisky Wood Ring Mens Etsy Rings For Men Mens Wedding Bands Tungsten Rings Mens Wedding Bands

Current Yield Bond Formula And Calculator Excel Template

Ferrari New 2015 Scuderia Ferrari F1 Race Thermo Drinks Mug Genuine Ferrari Formula 1 Travel Mug Of Stainless Steel With A Drinki Ferrari Thermos Ferrari F1

Native Remedies Sweat Less Natural Homeopathic Formula For Excessive Sweating 810845017336 Ebay Native Remedies Excessive Sweating Homeopathic

Unlevered Free Cash Flow Definition Examples Formula

Buy Lifebuoy Soap Bar Lemon Fresh Germ Protection 125 Gm Online At Best Price Of Rs 34 Bigbasket

Weighted Average Cost Of Capital Wacc Formula Calculation Example

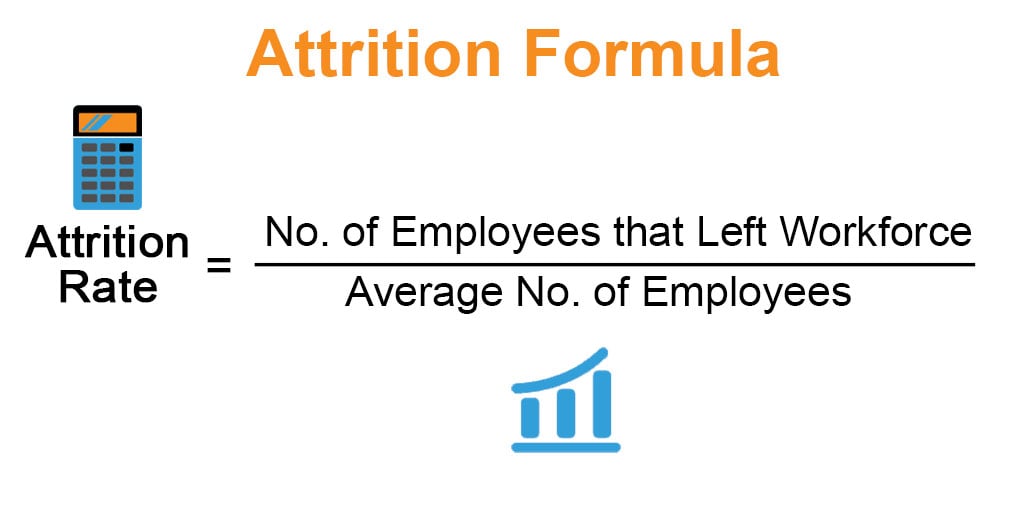

Attrition Formula Calculator Examples With Excel Template

Tag Heuer Formula 1 Watch 41mm Jewelry Accessories Bloomingdale S In 2022 Tag Heuer Formula Tag Heuer Tag Heuer Watch

Taxable Income Formula Calculator Examples With Excel Template

Pdf Tax Rate And Non Debt Tax Shield

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Lifebuoy Total 10 Soap Bar 125 G X 3 Bars By Lifebuoy Amazon De Beauty

Annual Percentage Rate Apr Formula And Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Google Es Mas Que Un Buscador Te Compartimos Sus Herramientas Ocultas Https Goo Gl M8ztaz Telecommu Logotipo De Google Buscador Google Buscador De Google

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)