schedule c tax form meaning

What is Schedule C-EZ. Section 501 c organizations and.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Schedule A is a US.

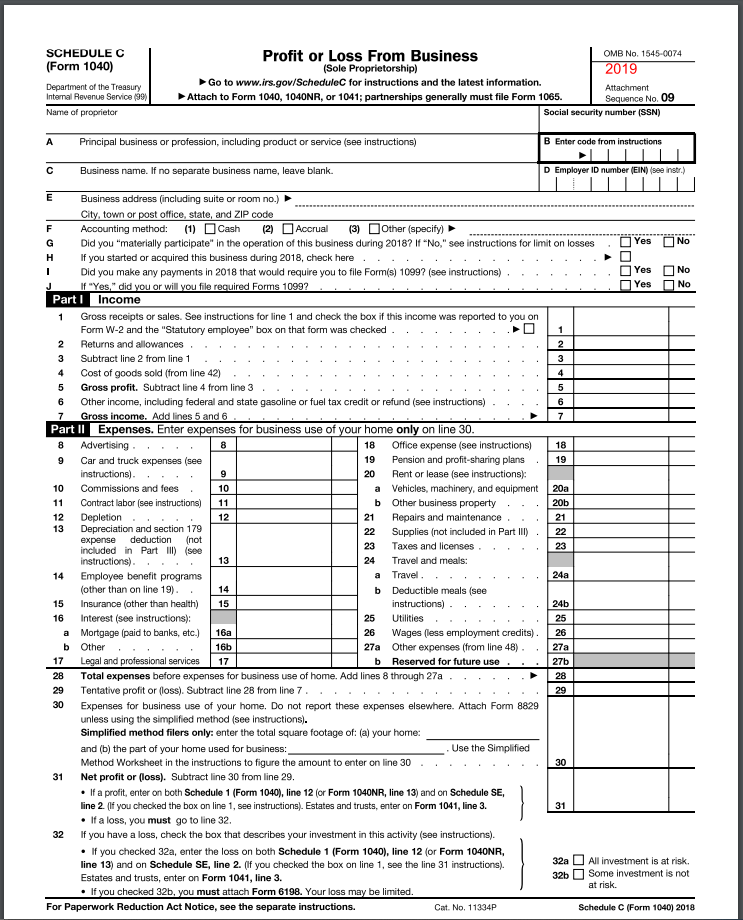

. The Schedule C. Part II Expenses. According to the form.

Schedule C is the tax form filed by most sole proprietors. SCHEDULE C Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for. Expenses for your Business are by far the most complicated aspect of reporting the business activity on the Schedule C form.

Many times Schedule C filers. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and the. Profit or Loss From Business Sole Proprietorship shows how much money you made or lost when you operated your own business.

That amount from Schedule C is then entered on the owners. Schedule C Form 990 is used by. What Is Schedule C.

After your calculation of expenses and income the form will show. A Schedule C Form is the way you report any self employed earnings to the IRS. The IRS Schedule C Profit or Loss from Business is a tax document that you submit with your Form 1040 to.

Profit or Loss From Business Form 1040. Schedule C is a schedule to Form 1040 Individual Tax Return. The 1040 The Schedule C.

Income tax form that is used by taxpayers to report itemized deductions which can help reduce an individuals federal tax liability. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Schedule C is a tax form for sole proprietors and other self-employed business owners use to report their business profits and losses.

These organizations must use Schedule C Form 990 to furnish additional. Schedule C-EZ was a. This article explains Schedule C and.

Its part of your individual tax return you just attach it to your 1040 Form at tax time. Schedule C is used to report your net profit or loss from a business. A Schedule C is one of the most important tax forms to complete for a business owner or sole proprietor.

The resulting profit or loss is typically. As you can tell from its title Profit or Loss From Business its used to report both income and losses. Schedule C is the IRS form small business owners use to calculate the profit or loss from their business.

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040.

Business Activity Code For Taxes Fundsnet

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

What Is Schedule C Who Can File And How To File For Taxes

Irs Schedule C Explained Youtube

What Is An Irs Schedule C Form Ramsey

About Schedule C Form 1040 Profit Or Loss From Business Sole Proprietorship Internal Revenue Service

1040 2021 Internal Revenue Service

Free 9 Sample Schedule C Forms In Pdf Ms Word

Schedule C What Is It For And Who Has To Fill It Global Tax

Business Activity Code For Taxes Fundsnet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

What Is Schedule C Tax Form Form 1040

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Easy Instructions For Filing A Schedule C Tax Form Silver Tax Group

How Much Will It Cost To Hire A Cpa To Prepare Your Taxes

Difference Between Nonprofit And Tax Exempt Mission Counsel

Given The Following Information Complete The 2019 Chegg Com

Miscellaneous Income Form 1099 Misc What Is It Do You Need It